If you are looking to learn what lead generation is and how to do it, this post covers that for you. This post talks about:

- What is lead generation?

- How lead generation works and how you can use it

- Different ways of generating leads

Why is Lead Generation For Financial Advisors So Difficult

Lead gen is getting more difficult, especially in high-trust sectors like financial services. Today, consumer trust is hard to come by, so you need to work on that for most of your marketing.

Make a genuine connection with your target audience to create brand awareness and attract more customers. The goal is to generate advocacy and loyalty.

Advice for Financial Advisors

Follow these pieces of advice for success.

Be a Specialist

As a financial advisor, you need to specialize in a niche by targeting specific demographics. Your niche is the differentiator that will distinguish your service from that of others.

Focus on Giving

In the financial planning industry, profit should not be the main focus.

The main focus should be building relationships and trust. Focus on building brand sentiment and engaging your audience without expecting anything in return.

Avoid These Mistakes

Make sure you do not commit these mistakes when generating leads.

1. Being Everything to Everyone

There is a lot of competition going on in this industry. If you cannot be different and stand out, you remain to be just another option. Being the ONLY option should be your goal.

2. Failing to Qualify Leads

It all starts with the buyer persona. Once you have identified your buyer persona, proceed to qualify your leads. Make the marketing process always highly targeted because it is the best way to generate more qualified leads.

3. Not getting proper training

Get your team trained. Your teams need to master marketing techniques like Facebook ads, SEO, guest blogging, and more.

4. Buying low-quality leads

Buy leads that are highly targeted. Also, focus on inbound lead gen techniques. It gives you better control of the quality of the leads you generate.

Why Focusing on a Niche is Beneficial For Lead Generation

Picking a niche allows you to:

- Dominate your market without competition from big players.

- Be the authority brand in that niche.

- Go easy on the budget (Niche marketing is more cost-effective per lead).

- Build brand loyalty (Tailor your service based on specific needs).

- Have more personalized services (Develop relationships based on trust).

- Higher conversion rate (You’ll speak to more qualified new leads).

Niching will help you create better reach your prospects through SEO campaigns for search, from blog post, your website, social media and traditional advertising.

Lead in the financial services industry can get expensive.

By having a niche you will reduce your budget allowing you more options for holistically reach your potential clients strengthening your brand and community.

What Is Lead Generation?

Lead generation is the process of getting businesses interested in learning more about the products or services before they decide to purchase.

The whole goal here is to get people interested, have an initial conversation with them, and ultimately, set up a meeting.

How Lead Generation Works

Simply put, lead generation is the function of running traditional or digital marketing campaigns to bring new leads into your sales funnel that eventually convert into clients.

It means using various techniques, be it direct mail, sales calls, digital ads, social media, or a blog.

There are two types of generating leads: inbound and outbound.

Outbound lead generation refers to the act of sending offers to your prospects with tactics like cold calling, pop-up ads, YouTube videos, and so on.

Inbound lead generation, on the other hand, is the reverse process. It is a customer-centric process, where the approach is passive, not direct.

It involves tactics such as SEO, keyword optimization, building links, etc.

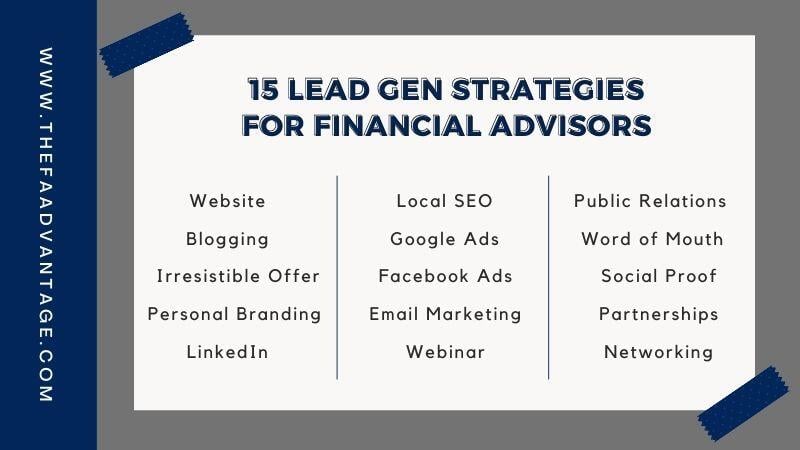

How To Generate Leads for Financial Advisors

The following techniques are ways and tools you can use to attract potential leads to your financial planning business:

Build a Professional Website

Build a viable lead generation website. The requirements for that include:

- CTA that is not “contact us.”

- Clear labels

- Visitor-centric navigation

- A balance between aesthetics and usability

Because “contact us” is the most used CTA phrase, many companies use it, and you can use it as well. But for your website visitors, this CTA might appear vague.

It is not clear what will happen after they fill up your form.

Instead, use an approach that spurs a specific type of action.

Even if phrases like “request for a readiness assessment” and “download a free trial” do not apply to your business, you can use applicable words like “talk to sales,” “book a meeting,” or “meet the team.”

Also, use clear text on buttons and make sure the text matches what users can do on the page the button will show them.

Clear labeling is essential throughout your website.

Aim for visitor-centric navigation. Users should feel comfortable navigating your site. The pages load quickly, and there is no confusion in terms of content and activities to do.

Being easy to understand and navigate is a hallmark of a user-friendly website, but there should also be a balance between usability and aesthetics.

Here are some tips for aesthetics:

- Include elements that add value to your site

- Design with the user in mind

- Choose colors that align with your brand

- Choose the right font

Also, build an SEO-friendly site that generates organic traffic. For that:

- Use relevant and informative content

- Use keyword optimization strategies. One of the best keywords to use is “financial advisor near me.”

In all, your website should be:

- Easy to read and understand

- Easy to navigate

- Inspiring, relevant, and informative. It should help drive visitors to action

- Strategically structured for SEO content-wise and keyword-wise

Make your website a channel to show your expertise and authority in financial matters and all about estate planning, tax planning, and investment management.

For some people, things become complicated, such as when they receive an inheritance from their parents.

Some are about to go through a divorce or wanting to increase their retirement funds.

Your website is one of the best platforms to show off your knowledge, competency, and proficiency in everything financial and in every imaginable case there is.

Blog and Blog Guest Writing

Blogging is one of the ways to share information about your businesses and services. It also serves as a medium to display your authority.

By crafting posts that help educate your customers, you can position your business as the go-to resource.

Many of your visitors who read your post will probably need additional information or have further questions to ask.

Thus, provide a way through which they can connect with you.

Establish your authority and credibility and provide ways for connecting, such as your contact details and links to your website.

Here is the thing. The more valuable the information you provide, the more visitors you can attract, and the more will Google favor you and rank you high in search results.

For guest blogging, access authority websites and see if you can post on those sites. Provide links at the end of each post.

Apply these principles when blog writing:

- Blog for conversions – Give readers the opportunity to take the next logical step. Use CTA and provide links

- Formatting and imagery – Make your blog articles visually digestible

- Frequency and consistency – 82% of marketers who blog daily receive positive ROIs for overall inbound efforts

- Focus on buyer persona – Blog on topics around the challenges and questions of your target audience

Irresistible Offers

Your business should find ways to offer freebies because giving freebies counts a lot for any business.

Customers want to try products first without spending money to do so.

Giving free financial advice will not hurt your business. Instead, the free counseling time is your opportunity to show how valuable your services can be.

Plan freebie strategies like a PDF document, free seminar, a 10-minute free consultation.

Make sure those free offerings are designed for the particular niche you want to serve.

Financial advisors often make the mistake of just wanting a lead.

Make sure your offer is so specific to your niche that when a lead does come in you know there’s a high likelihood they will become a client.

Irresistible offers are still a great way to gain more visibility and increase your client database.

Use Personal Branding

Leverage your personal branding for lead generation. Personal branding is the practice of marketing yourself and your career as a brand.

Here is how to do it:

First, you start by optimizing your presence online. You can do that by providing valuable and relevant content.

Financial advisors can start by registering on social media platforms – WordPress, Facebook, LinkedIn, Quora, YouTube, etc. You may also build your personal website for this purpose.

Then you proceed to create valuable content related to your expertise (i.e., Setting a budget).

Then answer questions on Quora, post informative articles on LinkedIn, post on your Facebook pages, and create your YouTube channel.

You can also tap opportunities to participate in forums related to your industry. Teach financial management and offer to counsel for free.

So, you will be leaving your digital footprints on the internet, and as you provide valuable information, people will flock to and follow you.

They will start appreciating your services, read your articles and watch your videos on YouTube.

The key is consistent content creation and providing value to your target audience. That is how personal branding works.

There is a big gap in financial advisors who have strong personal branding. If all things were equal, a personal brand can be the thing that sets you apart.

Use LinkedIn Correctly

One of the best mediums available for FA’s is LinkedIn. The platform can enable you to find target prospects and engage with them.

But you have to be tactful. The old-school methods of spray and pray cause you to burn more bridges than building true connections with prospects.

Use the LinkedIn publishing platform, an ideal space for financial advisors to engage prospects, create valuable relationships, and establish themselves as thought leaders in their industry.

Here’s a tip:

70% of financial advisors use social media for lead generation and engaging their audience. Out of that number, a whopping 90% use LinkedIn as their top social platform.

Now, a third of these advisors are generating at least $1 million AUM (Assets Under Management) through the LinkedIn platform.

Top tips for LinkedIn lead generation include:

- Be personal – You may not need to utilize automation when engaging with your LinkedIn audience. It is counterproductive when using such a platform

- Take advantage of the GROUPS features on the platform – On LinkedIn, you can reach out to people in your group because of the common bond you have fostered together.

It is an alternative to cold messaging, where rejections are not uncommon

- Create targeted content – The goal is to always stay in front of your audience with your valuable content.

If you are catering to the divorce market, you can create series of posts with headlines like “5 Financial Mistakes to Avoid During Divorce” or “10 Investment Opportunities for Divorcees.”

Local SEO

Here is why you need to focus on local SEO as well.

The most recent stats suggest that 82% of consumers use an online search to find local service providers, including financial and investment advisors.

Thus, work on keyword optimization for local targeting.

You want to be the first to be found if someone searches your services using keywords, such as “financial advisors near me” or “financial planner in Manhattan.”

Local keyword optimization is one strategy for SEO, but you can work with a marketing agency that can give you a comprehensive SEO approach with tactics, such as:

- Auditing your on-page SEO

- Accurate listings in online directories

- Updating Google My Business listing and correcting errors on Name, Phone, and Address

- Claiming ownership of citations

- Tracking profile views, phone calls, and direction requests

- Managing online reviews so you can respond immediately

Use Google Ads

Study Google Ads to check whether it can also work for your financial planning business.

It works via keyword bidding, and you can bid on keywords closely related to your business.

The trick is to trigger paid ads to show up on Google SERPs (search results pages).

With Google paid ads, you bid on the most popular keywords your target audience uses, but you only pay for the service when a user clicks your ads.

Your ads will appear on the bottom or upper portion of the search results pages where users can click on them.

Here is what Google wants you to know. Google records more than 112,000 searches for keywords financial planner or fee-only financial planner per month. You can bid on those keywords if you want.

Many financial advisors do not use this strategy. That is because they lack confidence in trying out Google Ads, or no one they know is using it anyway.

Again, a marketing agency can help. It can help you figure out how much you need to spend and how you can maximize results through the Google Ads platform.

Again, a marketing agency can help.

It can help you figure out how much you need to spend and how you can maximize results through the Google Ads platform.

Use Facebook Advertising

Facebook ads are the ads that people see when scrolling Facebook and Instagram pages.

You can create these ads with proper coaching.

It is one of the best ad platforms in the league of Google Ads and Bing Ads, where you can grow and scale your business with just some clicks and tactics.

- Use efficient formatting – Avoid complicated terms when creating your ads. Going for content that can be easily skimmed also works

- Highlight readers’ pain points – What is your audience trying to solve? Is it about tax, fees, or the length of time it takes to settle a financial issue? Address those concerns in as few words as possible

- Evoke emotions – Create your ads in such a way that you can generate the emotions that you want your audience to feel

- Always include a CTA at the end

In the financial planning industry, the main focus should be building relationships and trust. Focus on building brand sentiment and engaging your audience without expecting anything in return.

Email Marketing

Email marketing is one good way of building and cultivating relationships with your target audience.

The strategy also works for personalizing your approach, where you segment your email database and have different funnels based on clients’ financial requirements and goals.

When writing emails to your prospects, make sure that you stand out, and the way to do that is by keeping your messages short and to the point.

Explain briefly what your services are, your special offers, why they should choose you, and how you can help solve their financial concerns.

Also, one of the best steps you can take in email marketing is to create powerful headlines. 35% of emails get opened and read based on the subject line alone.

Email automation also works best for emails.

Email marketing automation services are an excellent way to keep in touch with a large audience with only a couple of clicks.

Webinars

According to a study, 20 to 40% of webinar participants generate leads that are qualified, but only about 5% actually make a purchase.

On the other hand, 73% of B2B marketers agree that a webinar strategy effectively generates high-quality leads.

If you choose to generate leads through a webinar, follow these tips:

- Segment the audience that you want to reach

- Create effective landing pages. Again, put in relevant content followed by a call to action in the end

- Present clear value propositions

- Make your webinar accessible on-demand

Public Relations

Today, PR is not only confined to media relations. The definition has become broader and includes influencer marketing, content marketing, etc.

For localized targeting, consider not using the mainstream press.

Instead, focus on getting your story out in vertical publications that cover the markets of your audience.

Also, have your PR and digital teams work together, and everyone targets the same goals which will improve lead generation for financial advisors.

For instance, you can create a podcast where:

- The digital team provides technological and promotional expertise

- And the PR team informs your audience about content

Use PR as a voice that resonates with the audience that is most important to your business and practice.

Word of Mouth

What is the impact on your business if people talk about your services among themselves?

“Oh, they are a delight to work with. They are truly interested in their clients’ needs and preferences.”

That sounds like a friendly conversation among those people, but to you, it means much more. It is the solid gold of marketing known as WOMM or word-of-mouth marketing.

You can promote WOMM across social media channels.

For instance, Instagram users are now engaged and equipped to shop, share their experience on the platform, and get paid for spreading the word.

This opportunity can democratize marketing for you and enable you to execute micro-deals within your customer base.

That also allows you to deepen customer relationships and ensure loyalty to your brand.

Social Proof

Displaying social proof on landing pages is an effective strategy in lead generation for financial advisors.

Some strategies you can use in providing social proof on your landing pages include:

- Leveraging the power of numbers – Provide data that can help persuade your audience to put their trust in you

- Feature testimonials – 87% of consumers read reviews before connecting with a brand

- Use trust badges – It tells consumers that what is promised through the ads is what they will get

- Influencers and well-known personalities – You want these people to back you up and tell buyers that you offer the best service people can find

Strategic Partnerships for Cross Promotion

Partnering with other companies will allow you to expand your reach.

In other words, it connects you with more potential customers through various marketing channels.

The way to do it is through collaboration and cross-promotion activities with other businesses.

Working with other companies, you can share strategies that work for you while copying the strategies that work for the other party.

Make sure that you work with companies that already have established names in the industry. Work with someone with a solid reputation.

The beauty of cross-promotion is that you get access to a new set of the audience without spending a penny for it.

Imagine throwing a party with a neighbor and using their space instead of your space. That is how it goes with cross-promotion.

Community Events/ Networking

Community events and networking can promote your brand directly to people.

The idea is to engage directly with your target audience using an in-person event (conference, networking meet-up, live version of your podcast, etc.) where you can showcase your personality and connect with your followers in a meaningful way.

If you think firsthand interaction with your company is the best way to engage with your customers, holding events for them is the way to do it.

Through events, you can impart in them the sense of the focus, personality, perspective, and commitment that you have in your finance practice and business.

Conclusion

Financial advisor leads are tough to acquire. Anything in the financial services sector requires a key focus on building trust.

Trust is not solely for high net worth individuals. It is across the board.

Don’t just play the numbers game and build your campaigns in a way that every lead has the potential to become a new client.

Attracting Better Leads Online

Our 2022 Marketing Report is 100% Free! Learn what it takes to be successful online with all the digital changes happening right now!

(No Email Or Anything Required)