Conducting webinars is a good way for you to connect with your prospects and promote your brand.

Webinars can generate revenue for your firm, especially if you have a traffic source.

We will discuss the benefits and some pros and cons of creating a webinar that delivers quality leads for your firm.

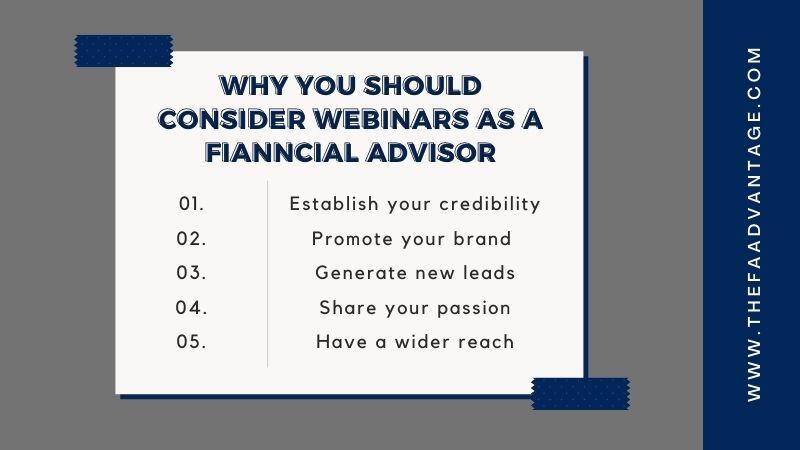

Why Webinars Are A Good Marketing Strategy for Financial Advisors

Take advantage of webinars as a platform to:

Establish your credibility

Take these opportunities to show your target market your expertise. It can result in increased trust and improved relationships with your existing clientele.

It is also your opportunity to persuade prospects that you are the best person to work with to solve their financial problems.

Promote your brand convincingly

Webinars are excellent public relations tools, which you can use to get your brand in front of your target market.

Every time you host an online event, it means an opportunity to increase brand awareness on online platforms.

Make sure to craft webinars that will show your authority in the financial niche and boost your brand status in the competition.

Generate new leads

Devise ways to make your webinars an engine for lead generation. According to sources, 20% to 40% of webinar attendees become qualified leads.

However, no matter how many qualified leads you have identified, make sure that you nurture these people until they become paying and loyal clients.

Develop a post-webinar lead nurturing plan for achieving this goal. This is where a strong email marketing campaign comes in handy.

Share your passion

There is a need for advisors to pick a niche that they know well and want to serve.

Your webinars are channels you can use to show that you have a deep understanding of what they want to accomplish.

Tell your story and how it relates to the financial situation of your audience. Tell stories of success. Your aim is not only to pique their interest.

You will also generate optimism among those who face serious financial hurdles.

In other words, humanize your content and empathize with your audience.

Avoid focusing too much on making sales in your presentations. There is no doubt successful webinars generate sales and profits, but these events should not be seen mainly as sales events.

These are opportunities to build relationships and trust.

Have a wider reach

Hosting webinars is an easy way to market your services on the internet but in an educational format.

73% of marketers say webinars are efficient marketing tools for generating leads. Also, recent reports show that a single webinar can generate at least 500 new leads.

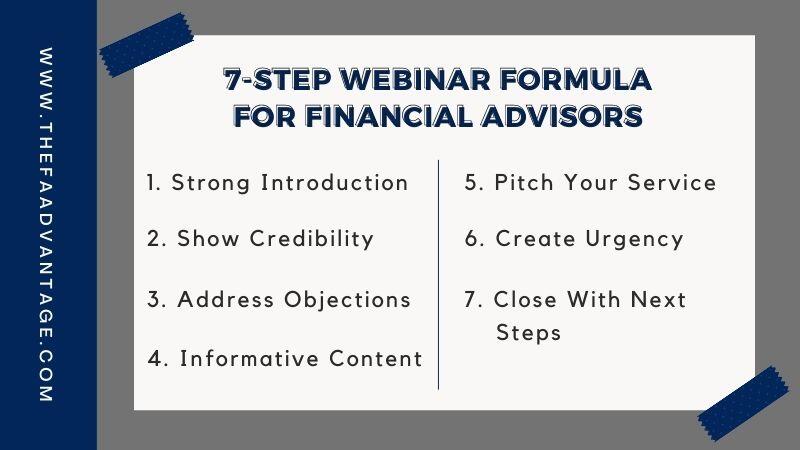

7-Step Webinar Formula For Financial Advisors

As a beginner in webinar marketing, these are probably the questions you are asking yourself:

- Is there an ideal structure for web presentations?

- How can I strike a balance between pitch and content?

- What is the best way to transition from coaching to selling smoothly?

Be clear about these questions before sitting down to craft your first webinar.

Also, follow these strategies to making a webinar that resonates with your audience:

1. Strong Introduction

Get clear early on what your audience can gain from attending your webinar.

Also, do not assume that your audience knows what they will do during your webinar. Will you run a poll towards the end?

Or should they prepare questions for a Q & A time later?

Keep your intro short. Do not linger on presenting the agenda of the webinar too much. You can cover these topics in-depth later in the presentation.

2. Show Credibility

Customers are looking for products that can help them and people they can rely on.

Use your webinars as a breeding ground for establishing reliability and credibility among your audience.

You can create a strong first impression if you do the following:

- Dress the part – Keep your attire simple and avoid being flashy. When in doubt, err on the side of formal attire.

- Maintain connection throughout the webinar – Even when you are reading a script or consulting your cue cards, looking straight to your audience will help make you appear open and confident.

- State your credentials – Degrees and affiliations prove your expertise. Can you show well-known people who value your expertise? Make mention of them.

- Establish a connection and a common ground with your audience – Do you have a common goal with your audience? Or a problem in common? State those in your presentation.

3. Objections

There are many types of customer objections, including:

- Lack of trust

- Lack of need

- Lack of budget

- Lack of urgency

- Product objection

- Contentedness objection

Which of these do you hear the most as a financial advisor?

Be aware of these objections because these are the same that you will face when conducting your webinars.

When faced with such objections, the first thing to do is acknowledge what your customers are saying. Compliment them for asking the question.

Then proceed to engage them more by asking a direct question to elicit more information.

As a financial advisor, you want to understand their goal and do your best to answer the objection head-on but steer the conversation back toward how you help them accomplish their goal.

4. Informative Content

The goal of webinars is to provide informative content.

You can be highly informative by doing the following:

- Pick a narrow topic – The generic approach to presentation is not effective in providing informative content.

Narrow your topic down to the point where you can address each pain point substantially.

- Interview webinars – Present influential experts in the finance industry, but make sure you provide them with a list of questions a couple of weeks before the schedule.

- Q & A webinars – Type of webinars with a high audience engagement rate.

5. Pitch

If the value you are offering your audience has been clear to them during the presentation, expect to have a smooth transition to sales pitching towards the end of your webinar.

During your sales pitch, tie your content to the product/ service you are offering.

You can now present your offering as the best solution to the pain point of your audience.

6. Urgency

After making your audience see the value of your service, now is the time to create a sense of urgency in them. Consider these tactics.

- Make use of the fear of missing out on a great offer.

- Make sure to avoid any barrier that might delay transactions.

- Personalize your sales strategy and give real-life examples of success stories.

7. Close

Here are the steps for closing a webinar.

- Launch call to action.

- Announce the conclusion of the event.

- Ask attendees to fill out a survey you can use for a follow-up.

- Express appreciation to the attendees and invited speakers.

- Optimize your engagement even as your webinar ends.

How to Choose A Webinar Topic for Financial Advisors

What are the expectations of those who will attend your webinar? Here is a short guide to choosing the best webinar topic.

First, take time to research your niche. What are the desires and fears of the people you are going to talk to in your webinars?

Business owners fear market fluctuations. Can you tell them in your webinars their best alternatives when markets plummet?

Parents want the best education for their children from the primary to the college level.

What are their investment options to grow their finances as they prepare for higher school fees in the future?

Are subsidies from the government viable? What are your projections in terms of educational finance?

Answer these questions as your build your webinar for this audience.

Another strategy to explore is using client surveys. Information gathered from surveys provides precious insights to understand what your audience needs or wants from financial advisors.

If you know what they need, then you can focus on those needs during your webinars.

Check online communities. What are people talking about concerning their finances? What are their concerns?

Can you find a way of incorporating in your webinars the insights you have gathered from these communities?

Remember, people express their needs whenever they can and talk with like-minded people to help them find better solutions.

Online communities are the platforms where these conversations are ongoing.

A financial advisor should research their competitors for ideas.

Find out what successful competitors are talking about in their presentations to give you an idea of what topics you can explore.

Financial Planning Topic Examples

Make sure you know your audience well, particularly concerning their unique financial challenges.

Is your focus targeted at people going through a divorce? There are legal and financial issues that are unique to this particular group.

As a financial advisor, can you lay out a plan for small business owners struggling to get by?

What about medical and health institutions? How can they sort out the financial challenges they face?

Are there special subsidies for these businesses? What about tax exemptions?

The key is to focus on a single topic and develop expertise on that particular topic.

What area do you think you will excel in as a financial advisor? Check the options below.

- Bonds

- Mutual funds

- Real estate investments

- Stocks

- Professionally managed accounts

- Financial issues emerging from life-changing events (starting a family, getting divorced, death in the family)

- Retirement planning

- Investment or Money savings

- Lump-sum money (redundancy payment, inheritance, etc.)

- Buying a property or getting a mortgage

- Social Security

Remember, picking a niche is vital in helping a financial advisor create effective content for your webinar topic and conversions.

Webinar Format (Live or Automated)

Depending on the options available to you, these are the two formats you can choose for running a webinar.

Live Webinars – webinars in real-time

Pros

Real-time interactions are possible with live webinars.

Not only that it allows you to respond to questions live, but you can also have a gauge of how critical financial issues can be among your audience.

If you feel you ought to test your knowledge through impromptu questions, this is your biggest opportunity.

Also, live webinars are non-repeatable webinars. That means this is a one-time event that will never be seen again.

Cons

Real-time interactions can be a major pro but also falls into the cons as well.

There can be moments when you may not be able give a satisfactory answer to your prospects.

Even if you tactfully inform your audience that you will get back to them later.

Technical issues can happen during a live webinar. Technical issues may arise from the side of your audience and also from your side.

Automated Webinars – recorded webinars

Pros

Since it is a recording, it can be watched by your target audience over and over again.

The webinar is also available 24/7/365. Make sure, however, that you use evergreen content with this approach. You can edit your webinar as you see fit.

Cons

It is automated, so there is no real-time interaction like what you can have with live webinars.

Also, people may discover that you will offer the same webinar later, so what is the point of them rushing?

Offer A Paid or Free Webinar

There is two options available – paid or free webinar.

Financial advisors can either charge attendees for the presentation itself or pitch a paid product after it.

Payment gateways, such as PayPal, allow webinar hosts to easily accept payment when prospects sign up to attend your webinar.

There are webinar programs with payment integration capabilities.

Paid webinars are always an option but we recommend providing as much value as possible before making the ask in the financial services industry!

Provide education through free content to help establish trust with your brand and clients. This trust will help you retain your clients long term.

Conclusion

Webinars for financial advisors are a simple methodology for teaching and selling.

You will teach your audience the best steps to solidify their financial stability today and for their future.

In turn, they become paying clients who will appreciate your counseling services.

Conducting webinars as a financial advisor is one of the simplest and easiest marketing platforms you can use in marketing.

A webinar takes only a few days to set up. For every webinar you conduct, you only need 30 – 40 minutes of actual teaching/coaching.

Then pitch your service at the end.

Allot 13-18 slides for that and spend about 40 – 45 minutes explaining those slides.

Make sure your webinar audience is highly targeted in terms of your financial planning topic.

If you do not, you may attract an audience with various types of savings and investment concerns that will not be an ideal webinar that will convert prospects into clients.

Attracting Better Leads Online

Our 2022 Marketing Report is 100% Free! Learn what it takes to be successful online with all the digital changes happening right now!

(No Email Or Anything Required)