To be successful as a financial advisor and grow your wealth firm, you need to attract new clients and focus on client retention the best way you can.

If you cannot retain clients, it will be a roller coaster to get customer leads.

You will turn them into paying clients; those clients leave shortly down the road and find you are back to where you started.

You spend a lot of time on outreach and marketing your business not to keep your new clients around.

What is happening on the ground is this. Financial advisors nowadays face investors who are sophisticated, knowledgeable, and informed.

In that case, professional knowledge, though essential, seems to be not the priority for clients.

Clients want more. They want more than competence, though that is very important.

Clients want more than the time that you speak about the bears and the bulls in the market or the viability of a real estate investment.

They want more of your time, enough to show them that you care for them as individuals and for their future.

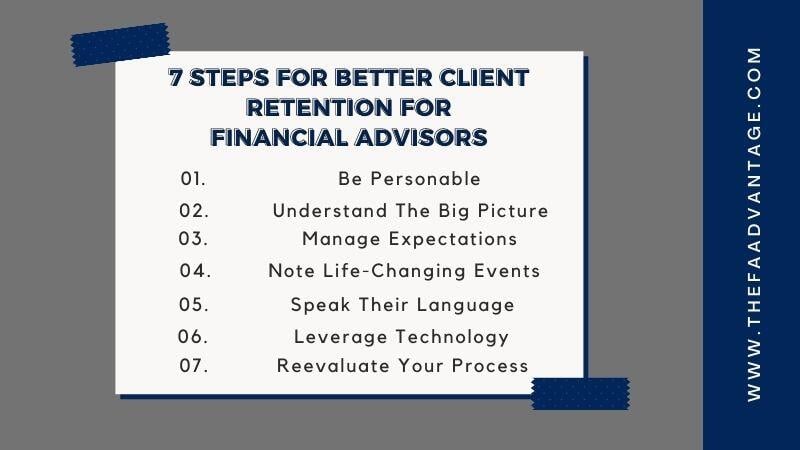

7 Steps for Better Client Retention for Financial Advisors

The willingness to teach, trying to assimilate in the culture of your target audience, and understanding the financial hurdles, are some of the ways to get your values across.

You want your clients to feel that you care and are not just there for their money.

Strategies to develop these interpersonal skills include:

Deal with your customers on a personal level.

As a financial advisor, your relationship with your clients is professional, but getting more personal with them is encouraged in your profession, too.

Keeping track of your client’s financial records is your job, but keeping a record of client information, such as special life events, can help you build a strong relationship with them, too.

Touch on their financial status in its entirety.

People appreciate companies that can go beyond offering a product and reaching out to them after the purchase.

Do away with the bad habit of connecting only for one time, and then you are gone.

Instead, understand the big picture and help your clients craft a plan depending on their goals.

Then suggest products that will help them achieve those goals.

It can be a time-consuming process, but that is the optimal way to build relationships with your clients.

Manage Expectations

I’m sure you heard the saying, “under-promise and over-deliver.”

Making sure your client understands what to expect from their investment based on their goals and plan you set for them.

If you are proactive here it can limit potential headaches in the future.

Keep tabs on life-changing events.

Regular interaction with your clients signals an intention to stay in touch with them.

For you, that is one of the best ways to ensure client retention.

Staying connected with your existing clientele opens opportunities to be around in events where they need to reassess their fiscal situation.

Here’s a few examples:

1. Childbirth (or pregnancy)

Advice couples to start considering life insurance and saving money.

How will they go about with the maternity/paternity pays they will get? Is it time to sell junk to increase the money in the bank, or is it time to consider getting a mortgage for a growing family?

2. Higher education

The child is still in the K-12 program. When should planning for his higher education commence? Are there grants they can use? What are the financial repercussions of such aids?

3. Getting married

What should be considered before marriage? There are many things like preparing a budget and tracking income and expenses.

You may go as far as teaching them the various options, including using a checkbook, a spreadsheet, or software for financial recording and planning.

Some people are going through a divorce, while some had just discovered an ailment.

Clients appreciate advice from their financial advisors during these troubled times and are likely to value the relationship with you more.

Speak their language.

The best advisors know and understand how to tune into the money history and personal stories of clients.

That includes cultural heritage, a determinant of what people are around money.

Familiarize yourself with the themes and issues of whatever group you may be interested in. It helps with understanding where your clients are coming from.

It also helps with the way you speak with them, in a way they can assimilate and comprehend.

What is their concept of money? Is getting rich a priority for them?

Concerning their fiscal experience as a group, what language, terms, expressions do they use to express finance concepts?

Leverage technology.

There are many things you can take advantage of technology. Think of CRM software.

It can help you keep the professional and personal details of your clients.

Record details of meetings and use the software to alert you about scheduled meetups.

All these can help endear you to your clients and build their trust in you.

Also, learn how to leverage social media. Take advantage of opportunities to engage with your customers and show people your authority and expertise in your niche on these platforms.

Also, on social media platforms, take the opportunity to engage with new leads.

People have questions about their financial situations, and they need answers from people who can guide them to the best solutions.

Offer the opportunity to people to engage with you more.

If you have a website, lead them to it for them to benefit more from you. Give a link to your site every time you engage with them on social media.

Post informative articles on various platforms to make the impression that you can help and are ready to help.

Reevaluate Your Process

The market changes and expectations change with it. Be sure to measure results and feedback from existing and previous clients and make necessary adjustments.

Building a Specific Niche

Remember that, as a financial advisor, you can be successful faster if you dedicate your service to a specific niche.

That is because you cannot be everything to everybody.

Also, investors are more sophisticated and wiser nowadays with the available options.

They look for a specialist who is an expert in the particular situation they are in.

Building a niche starts with knowing who you want to serve.

Do you have a heart for teachers, which is a group that is struggling to make ends meet with their meager salary?

Or do you want to offer assistance to local manufacturers and business owners who are looking for opportunities and thinking of expanding their business?

If that is what you want to do, go ahead.

Serve the people that you like helping and enjoy the relationships that will result from your efforts.

Conclusion

In a nutshell, if you niche, speak their language, educate and qualify leads before becoming clients will help build solid relationships and retain clients longer beyond simply being a competent financial advisor.

Clients leave for many different reasons.

If you understand what they are looking for when searching for financial advisors and working on the soft skills mentioned above will help you build strong relationships, loyalty and hold on to more clients long term.