Thought leaders who made it big in their industries have one suggestion for aspiring entrepreneurs: embrace niches. Nowhere is this more applicable than in the financial services industry.

Whether you are a newcomer or an ambitious entrepreneur looking to scale up, the more focused you are on a niche, the faster it will be for you to succeed.

Only by honing in on a specific niche can you have focus and clarity, be unique, and stand out as a top advisor in the financial services industry.

In other words, one cannot simply be a generalist anymore. By owning a niche immediately, you can have a clear advantage over other businesses in the same space. In addition, you can scale much faster than others.

Why Having a Niche Is Important

Financial advisors have two options for marketing your services online:

- Target anybody out there. Target all types of demographics. (We are experts in just about everything.)

- Keep your market small. (We have a focused approach, and we only target people that we love to serve and know well. Our operations are in the fields that we are good at.)

The problem for many financial advisors is they prefer the old ways of marketing. They think it feels easier to go out and prospect anyone and be everything to everybody.

In the end, they end up doing more work because:

- They compete with thousands of competitors, allowing big corporations to easily swallow them up and kick them out of the race.

- They cannot scale their practice because they target everyone everywhere without having focus. Thus, many advisors fail to develop competency in their service and profession.

What experts are trying to say is: if you want to stand out, you must build your own niche and grow it.

What’s the Difference Between Niche Market and Target Market?

The difference between a niche and a target market is this.

A niche is a smaller subset of the target market. If you search for a niche from your target market, you need to use a process called segmentation, which is basically a qualification process.

To segment a niche, you qualify prospects based on demographics, such as:

- Job

- Interests (sports, entertainment, financial investments, etc.)

- Socioeconomic status and roles

- Life events (divorce, academic aspirations, a child’s birth, migration, etc.)

Many financial advisors get niche and target market confused as they are very similar.

Having an understanding of your target market can be beneficial as well and should not be ignored.

Just understand that your target market is a much broader range.

Your target market will not afford you the benefits that selecting a niche will provide as discussed below.

8 Benefits of Niche Marketing in the Financial Planning Industry

Niche marketing is beneficial because:

Prospecting is less complicated

Niche marketing allows for targeting a fewer number of prospects. There is no need to siphon lengthy databases. You also get to bring your customer acquisition cost way down.

You become top of mind

In the minds of your audience, you are number one. When they think of quality financial planning services, they will think of YOU. This can also lead to increased client referrals.

You can close more leads

Lead generation becomes easier for your business. While word of mouth is the best strategy for niche marketing in your industry, you can also engage with your customers online to help drive organic traffic to your site.

You have less competition

You can run a business with little to no competition, which is not a remote possibility in this industry.

In addition, niche-focused marketing in the financial industry is not costly. Generally, the cost of acquiring a lead is between $44 and $262.

But with niche marketing, lead-generation pricing does not fluctuate that much.

The price is much more stable than that of generating leads for general practice.

Set your practice apart

Having a specialty requires specialized types of services where you can provide customized solutions to individuals. In return, you get the kind of recognition others cannot.

Ability to focus and achieve efficiency in one area

If a financial advisor focuses only on one niche, chances are you will gain high levels of competency over time.

This will be recognized and appreciated by your clients. There will be no denying of your value and will also help with your referral marketing strategy.

You feel confident

After acquiring mastery of your niche, the kind of audience you deal with, and the financial hurdles they face, you can always feel equipped for every case presented to you.

You can scale and expand fast

Niche businesses tend to grow and scale rapidly than their non-niche counterparts. With the addition of social media for example it has never been easier to begin scaling up your business.

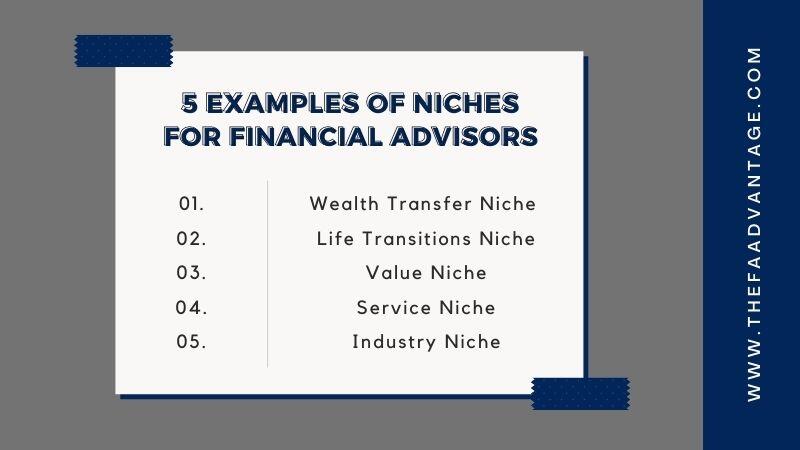

5 Examples of Niches for Financial Advisors

People have different backgrounds, interests, aspirations, goals, and circumstances. You can choose niches based on location, interest, job, ethnicity, or personal experience.

If you live in a location where there is a military base, and you can connect with military personnel, perhaps you can target these people.

Likewise, if you have a family of medical workers and were raised by parents who work in the medical field, you can choose to serve this market segment.

The advice is to drill down deeper to get the perfect niche. For instance, if you choose wealth management, you can still drill down through the wealth management market and choose retirees or people who want to be business owners.

Drilling down some more, you can choose retirees based on age or socio-economic status. Are you passionate about younger retirees or older ones? Are you interested more in retirees living in the upscale Los Angeles area?

Nonetheless, here are popular niches in the industry. Choose one and squeeze the juice out of it to discover the perfect market segment to serve.

Wealth Transfer Niche

Wealth transfer involves the sale of a company or inheritance. Now, this is one of the most profitable, according to projections. 10% of the total wealth in the US is projected to be moved to the next generation every five years.

Here are the key takeaways if you enter this niche:

- Baby Boomers are entering older age. Your job is to help these people figure out their legacy and how to pass their estates to their children.

- Keep an eye on tax minimization, family issues, and ensuring that assets are distributed as intended.

- Explain to clients factors such as long-term care insurance and end-of-life care.

Life Transitions Niche

Major life transitions often call for advice from financial advisors. These transitions are often sudden or unexpected (getting married or filing for a divorce).

As a financial advisor, your goal is to secure a healthy financial resolution for your clients. Along with that, you can also lend a helping hand by providing them resources that can help ease their sadness or pain of separation.

Life transitions management books, for example, can be helpful to these people.

Prepare yourself when you deal with cases like these.

Due to the complexity of life transition cases, clients disclose their financial statements from their bank accounts to the pieces of real estate they own. In the case of divorce, the client will hand over to you the management of their assets post-divorce.

Value Niche

This is all about familiarity or commonality.

Two of the best examples I have ever seen comes from seeing people come to realize they are in the same Fraternity/ Sorority or have served in the military.

These two groups seem to form an immediate bond even though they just met because of this shared experience.

Think about something you may be able to build off of based on shared experiences. This immediate bond can be huge in building up trust quickly and turning that prospect into a new client.

Service Niche

You may want to be known for a particular service that you offer. Lets say you favor Mutual Funds.

You can be the person known for helping people win with Mutual funds. Make videos on the topic, blog about the topic, and be the advisor that people turn to when they are ready to learn more about the benefits of mutual funds.

Industry Niche

You can target specific groups of professionals from different industries. Teachers and school supervisors from the education industry are an oasis of opportunities.

How about the construction industry (engineers, architects, etc.), where an economic boom in this industry can bring in vast amounts of wealth to these people?

From the medical field, you can also target doctors and specialists, dental clinics, etc. The health and wellness industry is a good option for niche marketing, too.

How to Pick Your Niche

You probably now have an idea in mind – a friend working in construction, distant relatives soon to retire, local businesses looking into expansion, etc.

There are endless possibilities, but make sure you follow these criteria:

- Is it a niche you are willing to spend time with? Are you good at that niche?

- Is that niche saturated? You might need to drill down more from A to A1, A2, etc. You can even go deeper to A11, A12, and so on.

- What is your background? Consumers tend to choose financial planners from the same place, industry, interest, affiliations, etc.

Remember, you cannot be interested in everything because to be interested in everything is counterproductive to business.

Know the segment of your audience that captures your interest the most and pick that segment.

How to Promote Your Niche

Whatever niche you want to operate in, word of mouth works the best.

If you already have a base of loyal customers, they can help you spread the word as long as they are satisfied with your work.

Some other strategies that work for promoting your business/niche include:

Listening

You will be confronted with questions, criticisms, and objections. Always be ready to respond accordingly and provide clarifications quickly. You have a reputation to protect.

Asking questions

Communicate with your current clients about how satisfied they are with the results. Some clients are 100% satisfied; others are not that satisfied as much.

Know why they are not fully satisfied and work on those weak points.

A survey

Send a form for your clients to fill up can be a tension-less approach to know how they feel, and gauge your services.

Emulate what is already working

“Emulate before you innovate.”

One of the best things you can do is research your competitors and see what they are doing to generate leads and clients.

This is not about copying what they are doing but using this as guidance on your next steps.

If they have a similar focus as you and are highly focused on Google Ads then it may be time for you to looking into how you can use Google Ads to grow your business.

Turning Your Passion Into Your Niche

The topic of turning your passion into your niche of choice is one that comes up often.

It can be a beneficial thing if you choose correctly. A passion should sometimes just remain your passion.

To help you decide let’s look at some things that can help you determine if your passion is a good option.

Know Your Passion

A niche allows you to target a distinct component of the financial planning market.

Nevertheless, always remember the reasons that got you to decide to put up a business when you were still starting.

Keep thinking and thinking until you find a niche that you are highly passionate about. To help you in drilling down, answer these questions:

- Where does my experience lie?

- What do other people remind me that I excel in?

- What do I love to do during my free time (even when I do not get paid for it)?

It might be counterintuitive to think that you need to drill down deep. But if you want to discover your purpose, you must sit down and think broadly.

Identify your skills and expertise.

That is the best way to obtain the knowledge needed to concentrate on a niche that can pave the way for you to spark a profitable business venture.

Is It Profitable

Once you have identified the niche you are passionate about, it is time to focus on turning your interest into a profitable venture.

This step pushes you to find prospects that you can turn into paying customers. You also want your passion to be an income-generating tool for you.

So, if you are good at niches A, B, and C, and your competitors are focused on A and B only, then you turn your eyes to Z and make it yours.

Besides looking for qualified prospects, you may want to operate in a field with less competition as long as it is in a sector that can afford financial services.

To Be Bold or Not to Be Bold

You must purposely force yourself to pick the right niche. If you need to conceptualize a bit, that is okay, too.

Analyzing your choices conceptually can drive you to go out of your comfort zone and force you to think outside the box. That is the space where most innovative niche propositions are born.

Be bold to innovate and start something new that others have not done before. That gives you an edge over your potential competition.

But understand that there could be a reason that your choice has little to no competition.

Make sure that you have actually found a gap in the market and not something that has been proven not to be profitable.

Find a Coach or Talk to Top Advisors

The first step to choosing a profitable niche is to hire a coach.

If you are budget-constrained, a viable option is to seek advice from top advisors in the country.

Most of these people are willing to talk to just anybody in need of help.

You probably would have a list of questions to ask, but no matter how many questions you want to throw, what you will most likely learn from them is this: The most important thing is having a niche or having a specific focus.

Do not forget to ask them about their niches. One would say they operate in a product niche.

Others would tell you they have an industry niche. How did they get started? How did they choose the best type of niche? Let them tell you their story.

Here are two examples:

Jared Reynolds of Wilkerson & Reynolds found his niche in his father’s line of work. His father was a bass fisherman, operating a resort the family owns on Truman Lake.

Adopting his father’s line of work as a niche came to Reynolds when he became a financial advisor. He asked his father if there was anybody in the industry who was doing what he was doing. The old man replied, “No, not that I know of.”

Today, the company grows mainly through word of mouth with friends and close business associates as their champion advocates.

And…

A group of people sharing the same ethnicity can be a niche, too. Julie Logsden is one pioneer of such an idea. Logsden’s ethnic roots are the Siletz Tribe in Oregon.

At first, the members of the tribe did not like the idea of working with Logsden. They wanted her to gain more experience first before they could take her in.

Remaining dedicated and consistent, she finally got the authority to manage the tribe’s fund.

As of the latest, she manages 70% of the tribe’s fund and wants to bid for more. She is also bidding out with neighboring tribes.

When asked about her niche, Logsden said that it is definitely a specialty.

Final Thoughts

Remember, industries are putting a high premium on expertise.

Have enough insights on how to be an expert on the niche that you have in mind. You can establish yourself there as a person of authority relevant to a particular audience or problem.

Do not be like others who have failed because they failed to come up with a solution to a particular problem.

If you join the pack of generalists in your industry, you will only drown in the crowd of forgotten names that eventually disappear like they never existed.