Gone are the days when effective marketing meant visibility on a park bench or a lamp post banner.

Digital marketing for financial services is becoming a modern, cost-efficient, and strategic conversion and communication channel.

Financial advisors and wealth management specialists looking to tap their target audience and lead in the financial services industry should consider digital marketing as their core strategy when coming up with financial advisor marketing ideas.

Let’s start with why and then we’ll show you the best digital marketing strategies not to ignore.

Why Financial Advisors Should Use Digital Marketing

There are many reasons why a financial advisor marketing plan helps build your brand and online presence, and here are some of them:

Connect with your target audience

When you research and define your target market, it is a matter of identifying their demographics, psychographics, online behavior, interests, and likes.

From here, you can create a well-rounded client persona that you can use to better connect with your ideal client once they discover you online.

Given that wealth of information, you can concentrate your digital marketing efforts and presence on the sites and apps they frequent and topics that interest them.

It makes sense to have a LinkedIn account if you are targeting potential clients or prospects who are executives or professionals.

If you wish to talk to a broader audience and have a lot of content to share, connecting through Facebook would be beneficial.

Financial advisors who have insights and forecasts to share and discuss can strengthen their positioning with newsletters.

Digital marketing for financial advisors allows them to segment and target your audience and curate the right messaging, and since we’re in the digital age of social media and search engines, they’ll easily be able to discover you.

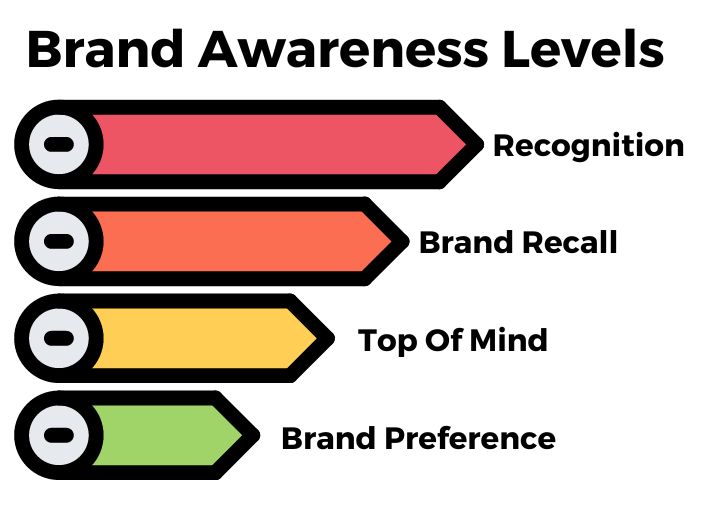

Brand Awareness

A catchy slogan, professional logo, or beautifully designed website is enough to get a prospect’s recognition and recall.

Forget TV or events. With the right strategy, you can use digital media to make your brand memorable and stand out in a sea of ads.

It helps to be a top-of-mind brand, especially when clients are deciding among other competitors, so your value and proposition should resonate the first time they read or come across your brand.

Increase Conversions

Conversions are much easier when the proposition is relevant and suitable to the prospect.

Digital marketing for financial advisors helps target the right product, offer, or message to the correct client segment.

The call-to-action is customized to reflect the individual’s stage in the client’s life cycle.

We commonly see these:

- Learn more – for prospects or Internet searches for your keywords

- Send a message – for those who are interested in what they saw in “Learn more”

- Call now – for those who are very interested to learn more about your offer

- Send me a quote – for those who’ve made up their minds and are in the purchase stage

- Share this post – for social media followers or existing clients who enjoyed or liked your post enough to share this with others

- Leave a Review – as a post-sales activity for recent clients

Get reviews and testimonials from happy clients as a testament to great service—and to entice future conversions.

There is nothing more convincing and trustworthy than “online” word-of-mouth marketing.

Extended Reach

The power of online media posting, reposting, and sharing is exponential and must be considered when coming up with financial advisor marketing ideas!

Social media content and emails are virtually permanent—unless deleted.

With engagement buttons such as “repost,” “share,” or “like,” there are many ways to make a post relevant again.

Sharing a post or tagging others is another way to extend reach and generate leads.

By doing the math, if one follower shares or tags 5 other friends, and you have 1,000 followers— that’s almost 5,000 eyeballs!

If your content is relatable and unique, it’s more likely to be shared and talked about, giving you the opportunity to go viral.

That’s an awareness win for your digital marketing team.

Control (Return on Ad Spend)

Your digital marketing efforts need to yield productive results and convert to leads, and one way is to track ROA or Return on Ad Spend.

This is computed as Revenue Attributable to ads/cost of ads.

With a digital marketing strategy, you have better control over your media placement and your advertising and marketing budget allocation.

For example, paid ads only charge you once the prospective client clicks.

That means your campaigns are hardworking and should be worth what you pay.

If you feel that your keywords or landing page are not converting to leads or sales based on your target, you can generate other search terms or amend your call-to-action as needed.

You can also halt a campaign if you feel that you’ve already reached your financial limit.

A digital marketing strategy is flexible and easier to control—unlike traditional media that require fixed space, content, and duration.

Qualified Leads

In the past, cold calls meant prioritizing quantity over quality.

The more clients called the more chances of booking an appointment. It was a numbers game.

With digital marketing, you can streamline your reach and leverage “push and pull” techniques to get more clients.

Regardless of the social media platforms, they all work well to create awareness and interest for your financial firm, and an easy-to-use sign-up page or interesting email blast will make reaching out to you faster.

Financial advisor marketing can incorporate specialized content or financial advice in the materials to your target niche groups and segments.

Ultimately, those who respond or hit the “Yes, I’m interested” button would most likely be your bull’s eye target market for qualified leads.

Digital Marketing for Financial Services

Having a solid financial advisor marketing plan is vital to creating successful digital marketing campaigns.

Here are the most effective strategies you need to consider:

1. Content marketing

Creating and posting content regularly make this strategy interesting, entertaining, and highly relevant.

Potential clients, especially the younger ones, love fresh and authentic content like posts, images, quotes, videos, or even the occasional funny or viral for a dose of humor.

Engagement with your content marketing is what will win their attention, conversion, and loyalty.

For a financial professional, your digital marketing efforts should aim to promote helpful, meaningful, and thought-provoking content that would make the prospect want to reach out to you.

As thought leaders in the industry, customers would look up to you for accurate forecasts or even actionable tips—so use your “knowledge” to your advantage for your financial advisor marketing.

2. Website

Your financial advisor’s website is your online brand representation, your digital calling card.

The most successful financial advisors once thrived in face-to-face meetings and office appointments.

Your website now stands as the digital head office—the centralized repository for all content, achievements and commendations, services offered, team members, client testimonials, and how to contact you.

Even when you cannot meet or invite new prospects for coffee, this is their way to get to know you.

Populate your financial advisor’s website with relevant articles, professionally taken photos, and an easy-to-use, easy-on-the-eyes layout and color template.

Whether searched organically or shared by a friend, make an impressive first impression on your ideal clients!

Lastly, don’t forget about mobile. Mobile is becoming more important as the years pass and could cause you to lose out on traffic and leads because of a poorly optimized mobile experience.

3. Blogging

Blogging is an add-on activity you can bring to the table and reap the rewards as a content creator.

There is added respect when you can curate your content and blog posts and lend your expertise through articles and features that you publish on your website.

Sharing your knowledge in financial services or wealth management advice for industry-related questions is a way to showcase your credentials and show you as a subject matter expert.

This raises your credibility and trustworthiness—both of which are key traits clients are looking for in a financial advisor.

4. SEO

Effective search engine optimization (SEO) brings new prospects to your website or your designated landing page.

Simply put, it ranks higher in the Google search for certain keywords used to search for you, your competitors, or even your industry.

Being easily searchable has its perks, and number one is an increase in traffic.

Imagine a simple search for “wealth management expert,” and you appear on the first page.

The chances of being clicked are much greater than the succeeding pages.

Good SEO is all about analyzing what customers use to search for you or similar companies—and also keywords that you constantly use in your content and posts.

The more Google associates these keywords on your site, and the more it is visited, the higher your ranking. Together, they can help improve your organic SEO.

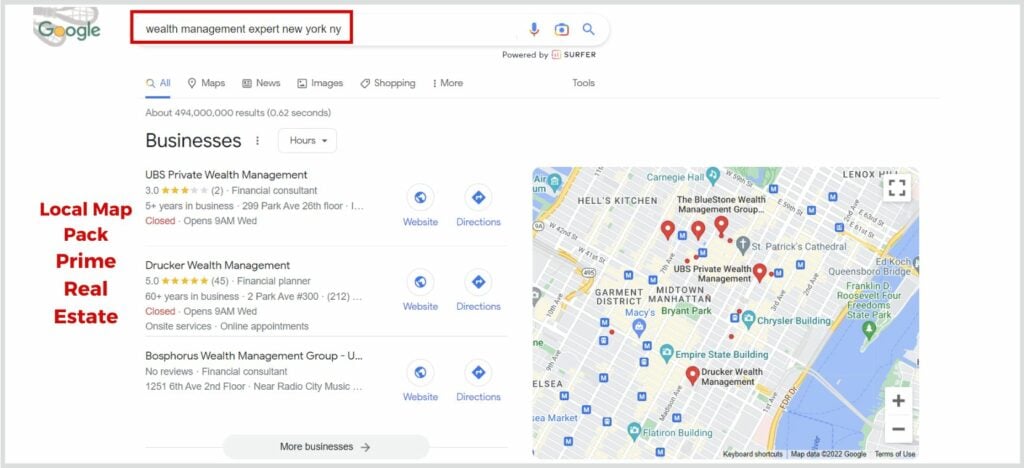

5. Local SEO

When wanting to use search engines to target your niche market location, turn to Local SEO.

If you thought being searchable by adding a few relevant keywords was life-changing, try adding the geographical aspect.

This is greatly helpful when there are certain areas or locations that you want to “own.”

Think of how appearing in a search for terms like “Wealth management expert New York NY” would do for your advisory firm.

If your firm has several offices in different areas, it makes sense to be easily searchable by your company name or industry + location.

This will integrate with the search engine’s Google Maps, and both you and your business location will appear on every relevant search.

Citations can also help cement your name and location if certified or cited by others through reviews, directory entries, or a location tag.

6. Email marketing

Email marketing is like the cold call of the new age—but faster, less time-consuming, and a lot easier to manage.

Email campaigns are designed or sent out depending on the client’s need, solution requirement, or special occasion.

A simple “Happy Birthday!” is worth a lot to any celebrator.

Emails have so much potential—to create awareness, build engagement, inform, and invite to webinars—so the goal is to build your list and keep growing it.

Find templates and images that reflect your brand guidelines, and stick with that. With your customized logo, header, and engaging content, click and open rates should go higher.

Treat your email marketing list, and plan an effective, relevant, and non-intrusive email campaign.

Personalize your emails, and don’t always make a hard sales pitch or repetitive offer.

Trust in the financial services industry is largely based on relationship building, so make your emails work that way.

7. Social media marketing

Social media marketing is the heart of engagement, and you can optimize your online visibility with efficiently managed platforms.

Don’t be overwhelmed by the many forms of social media.

After all, if you are managing a single financial services brand, your content should be consistent, executed, and tweaked slightly depending on the platform and target market.

Consider an official Facebook and Instagram account for your informational, social, advice, and other content.

A roster of media (gif, image, video) will keep your followers attention. Sharing news or blog posts from Facebook is a quick way to get YouTube and website visitors.

Your social media posts from Twitter can mirror what’s on Facebook and can reach people who are not on Facebook.

TikTok and Snapchat should also be considered if you are targeting the Gen Z crowd who may find video content and influencers their respected source of information.

On the other hand, if you are keen on capturing professionals or the working class, taking your branding to LinkedIn would be a sensible choice.

Don’t forget to join or participate in groups or networks for similar industries, financial services, trends—and where your target market’s interests are!

It’s an excellent way to engage with them in different channels and learn more about the VOC (voice of the customer).

Lastly, a calendar is a core part of a social media strategy.

You’re not expected to come up with content on the fly, and having a calendar makes it a long-term plan that you can easily strategize with occasions, webinar dates, and rotating media types to prevent reader fatigue.

➡️ We recommend Dripify for your LinkedIn outreach. It is one of the most natural feeling campaigns you can run, even though it’s completely automated!

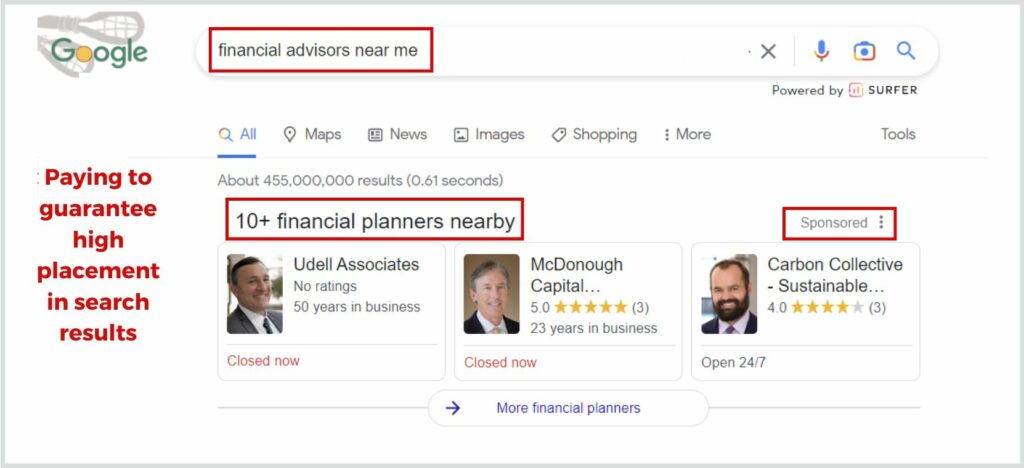

8. Search Engine Marketing

Search Engine Marketing (SEM) is the paid version of SEO to increase search visibility.

SEM gets you a top slot on the search engine results once your client types the selected keywords.

This is why keyword research is crucial to your success here.

A guaranteed top (and front) spot is premium real estate that ensures your potential clients see you first.

You’ll only pay once the client clicks on your ad.

Complement your SEM campaign with other digital marketing tactics (social media + email) to get new clients searching, clicking, getting interested, and setting appointments with you!

9. Video Marketing

YouTube is becoming quite a hit for “how-to videos” or to answer “search” questions, so it deserves its place in one of your financial advisor marketing strategies.

Video marketing is the best way to capture their attention and interest when people are too lazy or bored to read about financial advice or how to make money.

Wealth or financial management may be too serious or plain to read, so placing answers and snippets of information in a video format makes it easier to comprehend and more interesting to watch.

Add some music, effects, and subtitles, and you can win over fans as you showcase your knowledge on investments, life insurance, or even equities.

Make it a series so that potential clients will follow your page and channel, and others who come across your page will also be engaged.

Videos that are very basic and faceless get thousands of views.

Contrary to what many believe, this can be accomplished with low effort and minimal skills in video editing.

10. Webinars

A step up to video marketing is planning and holding a webinar.

Don’t let location or social distancing constraints stop you from conducting a talk or seminar.

Hosting a web seminar will make it convenient for more to attend—and they can share the invite with others too!

Here’s a chance for you to showcase your financial skills and expertise and present what you know and offer to individuals who would likely be interested in your exceptional client services.

The webinar isn’t only limited to sales and brand recognition.

You can feature solutions to well-researched client issues (i.e. inheritance, family-owned small business, first-time investor, etc.) or feature a niche offering that only you have.

You can hold interactive sessions, Q&As, and invite guest speakers—all of which will spike interest, especially when clients and prospects are involved in the discussion.

On the side, you can conduct business strategy plans and recruitment sessions for those who want to join the business but are too busy at work or live far away.

Webinars can help achieve other objectives of the business without the huge costs of holding live events, sponsoring seminars, or joining TV shows.

Financial Advisor Marketing FAQs

How much do financial advisors spend on marketing?

As a good starting point, those interested in growing their advisory business and targeting a large audience should allot about 4% to 10% of their revenues to financial advisor marketing.

The marketing mix should include digital marketing and its customization and automation capabilities.

Is Digital Marketing useful for finance?

Of course!

Digital Marketing is useful for any business and industry because it builds brand awareness, reaches your target audience with the right call-to-action, and increases traffic to your website or social media accounts.

A digital marketing strategy can ultimately support a financial services company’s objective of boosting sales, revenues, and client loyalty and satisfaction.

How much does a digital marketing consultant cost?

Depending on the complexity and services required, a digital marketing consultant’s costs can range from $2,500 to $12K monthly, or if you’re eyeing a one-time project, that’s $1K to $7.5K.

Another average you can look at is the hourly rate, that’s about $140 (worldwide average) and $161 (US average).

For reference, some digital marketing services can be individually selected with a ballpark figure:

- SEO – $500-$20K monthly

- Email Marketing – $0.1 – $0.5 per email

- Social Media – $250 – $10K monthly

- Website Design – $2.5K-100K

Regardless of the digital marketing package or services required, always remember that a good overall marketing strategy will help your financial firm reap benefits exponentially in the long run.