If you’re a financial advisor looking to market your services, it’s important to create client personas.

Client personas is a semi-fictional character that represents your ideal clients, based on real data about your existing clients and potential clients.

By understanding who your ideal client is, you can create a marketing plan that resonates with them and attracts more business.

Think about it this way, if you were tasked with writing a retirement letter for a client, the best letter would mention personal aspects like family, hobbies, and goals.

However, if you didn’t know anything about the client, you’d be left with a generic letter that could apply to anyone.

Creating client personas ensures that your marketing efforts are targeted and personalized to appeal to your ideal clients. Having this approach will help you focus your time and resources on attracting the right clients, rather than casting a wide net and hoping for the best.

How to create buyer personas as a financial advisor?

The client persona is a fictional depiction of the person or persons you desire to reach with your marketing and provides a realistic image of who that person is.

Have you ever tried to record yourself on camera talking about your product or service? You are talking to no one but trying to connect without cues like reading body language can be difficult. This is where client personas come in to help you hone your message.

Creating client personas for your financial advisor marketing provides you with a guide for creating content that will actually speak to the needs of your target market. It allows you to connect with them on a personal level and ensure that the language you use resonates.

When creating client personas, you want to make sure to include the following information:

- Name and age

- occupation

- marital status

- children (or other dependents)

- location

- financial concerns/goals

- spending habits

- technology usage

Even within a niche market, your target market has probably 2-3 buyer personas.

A client persona takes into account many other factors including the needs of your clients and their lifestyles and their needs as they relate to your business services to the customer.

There are a few key elements to creating client personas that are helpful for financial advisors:

1. Define your target client.

Who are you trying to reach with your marketing?

2. Gather data about your target client.

This can include surveys, interviews, and market research.

3. Create a profile for each client persona.

This should include information like demographics, psychographics, and behavioral data.

4. Understand what motivates each client persona.

What are their goals and concerns?

5. Tailor your content and messaging to appeal to each client persona.

Use language that resonates with them and speaks to their needs.

By creating client personas, you can be sure that your financial advisor marketing is on target and connecting with the right people. Take the time to create client personas for your business and watch your marketing success improve.

Tell me the benefit of creating buyer personas?

The goal of creating buyer personas is to identify and attract your ideal clients with a fraction of the effort cost of less targeted marketing campaigns and convert them to clients for long.

Create a buyer persona to boost your digital marketing efforts.

The latest survey found that 56 percent of business owners believe new customers are the top driver for growth. Despite this, social media has surpassed referrals as a source for generating new leads and converting them into new clients.

This is why a client persona is so beneficial to your digital marketing strategy.

When you know your target market, you can better identify where they hang out online and create content that appeals to them. You can also tailor your social media posts, ads, and email campaigns specifically to reach these individuals.

The more relevant your content is to potential clients, the more likely they are to engage with it. As a result, you’ll see a higher return on investment for your marketing campaigns.

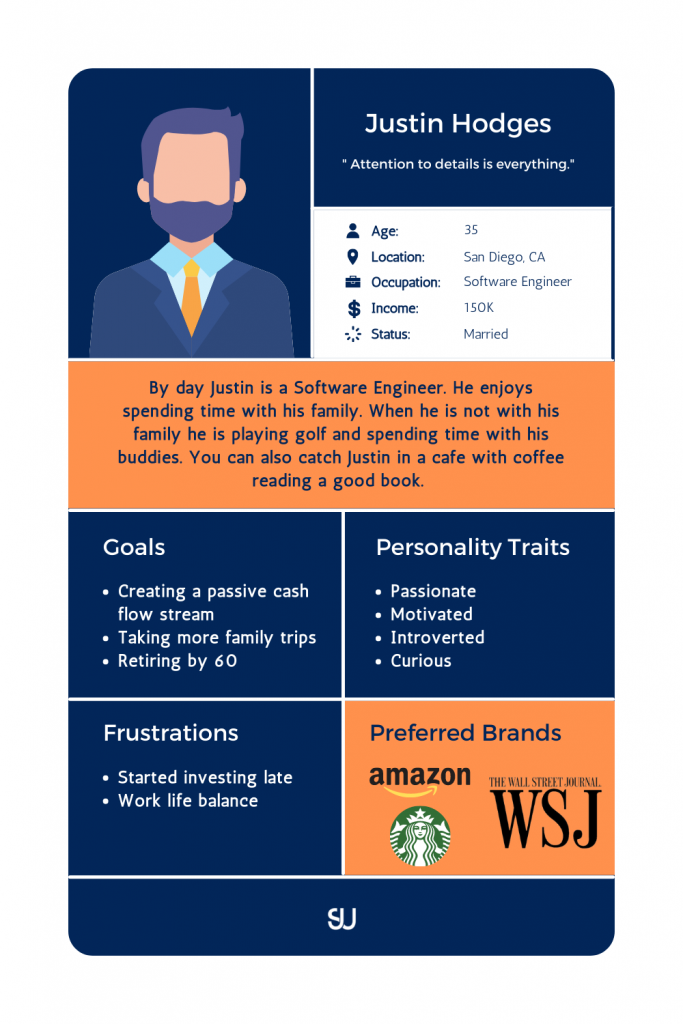

If you’re not sure where to start with creating buyer personas, consider using a persona template like the one below.

You can get the fillable version of this template and other financial advisor templates in our founder’s book, The Digital Shift: How financial advisors can survive the digital marketing shift happening with A.I., data privacy, and the consumer trust fallout. Get the book free on Kindle Unlimited.

Making client personas work for you

Your client personas are storyboards to help guide what to say to your target audience through email, blogs, webinars, and presentations.

You can sharpen your messaging in order to reach an even greater audience. Then you could narrow the focus on the project more efficiently.

For financial planners, client personas are essential in order to understand what type of client you want to work with. By understanding your client’s needs, wants and pain points, you will be able to serve them better and build a stronger relationship.

The more relevant your messaging is to your client persona, the more likely they are to respond. Keep in mind that not everyone who needs your services will be a good client fit, so it’s important to target the right people.

Creating client personas can help you do just that.

Communicating your niche

How do I find the target audience you’d like to build your client persona around? If you answer correctly, you’ve got an important foundation for growth.

The first step is to understand your client’s needs. What are their pain points and what do they want? Once you know this, you can communicate it in a way that resonates with them.

Start by doing your research. Who are your client’s competitors? What do they offer that your client doesn’t? Once you have a good understanding of the market, you can start to niche down.

Niche marketing is all about specialization. You need to find a way to differentiate yourself from the competition. This can be done through branding, targeting a specific audience or offering a unique product or service.

A client persona strengthens everything you do with your niche if you take the time to do it right. This means that you should be able to answer the following questions:

- Who is your client?

- What are their demographics?

- What are their interests?

- What are their needs?

- How can you reach them?

If you can’t answer these questions, then you need to go back to the drawing board.

Building a client persona around your niche is one of the most important things you can do for your business. It allows you to focus your efforts on the right people, and it helps you to communicate with them in a way that they understand.

Take the time to get it right, and you’ll be well on your way to success for your financial planning business.

Buyer Personas are at the heart of effective digital marketing for financial advisors

Successful digital marketing strategies depend upon delivering the right message to the right platform and target audience. And that’s where buyer personas come in.

By now I’m hoping you understand the importance of a client persona.

My goal was to drill down on some crucial aspects that you should remember in developing your client persona and attracting your ideal clients.

This is not the sexiest of marketing topics but one that can be huge in terms of your success.

If you can answer these questions, you’re well on your way to building an effective digital marketing strategy that will attract your ideal clients. And that’s the whole point, right?

You CAN’T Be Everything To Everyone

Predicting that everyone could benefit from having financial planning advice is also untrue. Everyone’s financial situation is unique, and what works for one person may not work for another.

A financial planner must tailor their marketing to each client persona, taking into account their specific goals, assets, and liabilities. Trying to be everything to everyone would be impossible, and could lead to poor performing marketing campaigns.

Instead of trying to be all things to all people, financial planners should focus on finding their ideal client. This is the client that is most likely to benefit from your services, and who is also most likely to be a long-term client.

Targeting your marketing efforts towards your ideal client profile will result in better returns for your business and a more satisfied client base.

With financial advisors only bringing in a couple of new clients a year on average it is helpful to get this right and work with people that will stick around for a while.

What type of clients do financial advisors work with?

Fixers, survivors, and Protectors are one of the most commonly encountered client personality types when working with wealth advisors.

Each type of client brings with them their own unique set of needs and concerns that the advisor must be aware of in order to provide the best possible service.

Financial advisors must be able to quickly adapt and cater to the specific needs of each client in order to maintain a successful relationship.

Some of the most common types of clients that financial advisors work with include:

Fixers

These clients are often highly analytical and detail-oriented. They want to be sure that they are making the smartest financial decisions possible and will often do their own research before seeking professional help.

Survivors

Clients in this category have typically been through some sort of financial hardship and are looking for help getting back on their feet. They may be hesitant to spend money on anything that isn’t absolutely necessary and can be difficult to persuade to make changes to their financial plan.

Protectors

Protectors are typically the family breadwinners who want to make sure that they are doing everything possible to provide for their loved ones. They are often very hands-on when it comes to their finances and want to be actively involved in all aspects of their plan.

Each of these client types presents its own set of challenges and opportunities for financial advisors. By understanding the different personalities that they work with, advisors can better serve the needs of their clients and create long-lasting relationships.

Final thoughts on creating buyer personas

When creating your own buyer personas, be sure to consider the different types of clients that financial advisors work with. By understanding the unique needs of your ideal client, you can better serve their needs and create lasting relationships.

As you know in the financial planning space it’s all about trust. Being a financial planner that someone feels they can count on is of the most importance when you are wanting to improve client acquisition.

A customer persona is the bridge that can help you accomplish this long term.