When it comes to life insurance advertising, a few key strategies can help you effectively scale up your lead generation efforts using PPC marketing.

These strategies include using targeted keywords and phrases in your ads, leveraging social media platforms to engage with potential customers, and optimizing your website for search engine visibility.

When trying to do it all on your own, it is essential to understand the fundamental concepts of pay-per-click advertising in order to reach potential customers effectively.

One effective strategy is to focus on keywords and phrases relevant to your target audience.

This will help you ensure that your ads appear in search engine results when users are actively looking for products or services you offer.

Another essential strategy is to utilize social media platforms such as Facebook, Instagram, and Twitter in order to engage with your audience and build brand awareness, trust, and loyalty.

This might involve sharing helpful content relevant to your target market or creating targeted ads specifically designed to appeal to potential customers.

Why insurance PPC advertising is important for insurance agents

Insurance agents understand the importance of advertising their life insurance products in order to reach potential customers and increase sales.

While many insurance companies rely on traditional marketing channels such as print, radio, and TV ads, innovative online marketing strategies can also be used to promote insurance products.

The reason digital marketing is highly effective in that it allows insurance agents to target specific audiences based on their interests, location, and other demographic information.

This can help ensure that ads for your insurance products are delivered to the right people who are most likely to be interested in purchasing coverage.

Other effective digital marketing tactics include Facebook ads, Linkedin ads, and Instagram ads to engage customers about life insurance topics.

When it comes to this insurance strategy, it’s essential to consider all your options to reach the widest audience possible.

By utilizing both traditional and digital marketing channels, you can ensure that your message is getting in front of potential customers who are most likely to be in need of a policy.

Insurance PPC marketing ideas

The options available to an insurance agency may seem endless. Still, you can successfully connect with consumers and grow your insurance business with the right approach.

Here are some of the most effective insurance marketing ideas for your advertising campaigns.

Pay Per Click ads (PPC)

PPC (pay-per-click) ads are a form of online advertising that allows insurance companies to display their ad on a search engine results page (SERPs).

When a user clicks on one of these ads, the insurance company pays a small fee to the search engine.

PPC advertising can effectively reach potential customers who are actively searching for life insurance products online. However, in order to be successful with this strategy, it’s important to create ads that are relevant and targeted to your target audience.

Email marketing

Email marketing involves sending promotional messages to a list of subscribers who have opted-in to receive your emails. This can be an effective way to keep customers and prospects engaged with your insurance agency. It can also be used to promote special offers or new life insurance products.

When creating an email marketing campaign, it’s essential to ensure that your messages are clear, concise, and relevant to your audience. You should also include a call-to-action (CTA) so that recipients know what you want them to do next.

Social media ads

Social media platforms like Facebook, Twitter, and Instagram are effective ways for insurance agents to engage with consumers and build brand awareness.

By sharing helpful content, interacting with followers, and promoting special offers or promotions on your social channels, you can connect with potential customers in a meaningful way.

To get the most out of your social media advertising efforts, you need to understand that creating eye-catching and engaging ads is essential.

Additionally, you should include a strong call-to-action so that users know what you want them to do next. With these strategies, you can successfully reach consumers on social media and promote your insurance products.

Video Ads

Catching the attention of potential customers can be difficult, especially if they’re not actively looking for life insurance products.

This is where video advertising comes in.

Video ads are a powerful way to reach potential customers and promote your insurance products.

These ads can be used on social media platforms, websites, and video sharing sites.

This works so well because you place your insurance ad on relevant videos they are already watching and interested in.

If you focus on starting your ad strong in the first 5 seconds, you’ll get much better results from your campaigns.

With more and more people making video their preference for consuming content, not putting some effort into video ads is causing you to miss out on many leads.

How to create an effective insurance PPC campaign

Insurance industry PPC ads can have a fantastic return on investment or be a total flop.

If you want your plans to succeed, you need to understand the process of creating your PPC campaigns.

Once you know this, you can create ad campaigns that resonate with your market and lead them to take action.

Here are some tips for creating an effective advertising strategy to promote your life insurance policies, health insurance, and other insurance products:

Know your target market

Insurance providers have a wide array of potential clients, so it is crucial to connect with the specific groups that are most likely to be interested in your offerings.

Conducting market research can help you understand your target audience’s needs, behaviors, and interests, which can inform the content and messaging you include in your ads.

Set a realistic budget

PPC Advertising can be expensive, and insurance providers often have strict budgets to work within.

When setting your ad budget, it’s essential to make sure that you allocate funds in the right places and choose the most cost-effective channels for promotion.

Doing so can ensure that your ad campaigns reach real people while remaining within your budget.

Set S.M.A.R.T. goals

In addition to setting a realistic budget, it’s essential to set specific, measurable, attainable, relevant, and time-bound goals for your pay-per-click campaigns.

This will help you track your progress over time and see results from your efforts.

Then, with clear targets in mind, you can work towards meeting those goals and improving your campaign’s cost per click and ROI.

Utilize multiple channels

While traditional advertising methods, such as TV spots and print media, are still effective, insurance customers widely use digital channels today.

To reach your campaign’s broadest but most specific target audience, you should include a mix of different marketing channels with pay per click strategy.

This can include everything from developing a solid social media presence for retargeting to forum PPC ads to reach customers as they search for solutions.

By following these tips, you can create an effective insurance PPC campaign strategy that will help you connect with potential customers and grow your insurance company.

Set up your landing pages

When running digital advertising campaigns, sending your traffic to landing pages relevant to the offer is essential and designed to convert visitors into insurance leads.

You can get more leads if your landing page is free of distractions, easy to navigate, and include a strong call-to-action.

You can maximize your conversion rate and grow your insurance business by setting up an effective landing page.

Create a strong brand identity

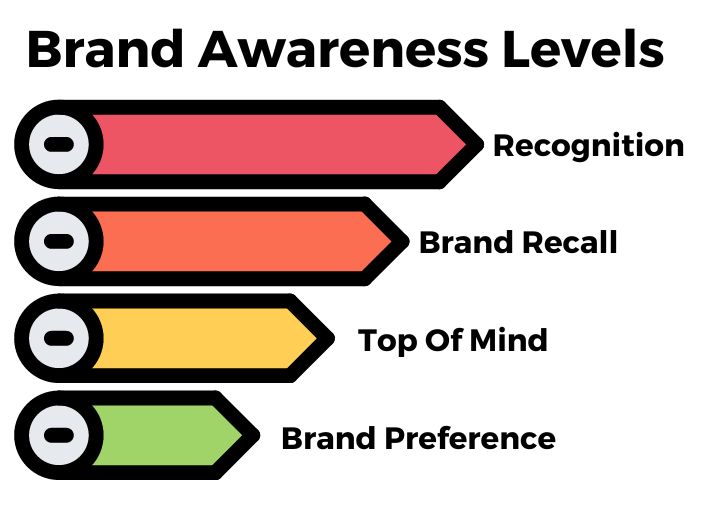

As you develop your PPC campaigns, creating a consistent brand identity that resonates with your potential customers is essential.

This means using brand assets that are clear and memorable such as your logo, color palette, and messaging that reflects your brand values.

Additionally, it’s essential to deliver a consistent customer experience across your marketing campaigns so your ads are recognizable and help your ads perform better through all brand awareness levels.

Include a strong call-to-action

Including a clear and direct call-to-action in your insurance PPC campaign is essential if you want to convert leads into clients.

Your CTA should be specific, actionable, and easy to understand.

Additionally, it should be relevant to the offer and aligned with your overall marketing and business goals.

You can increase your likelihood of generating new clients by including a strong call to action.

Be sure to touch on that emotional connections to trigger a better response to your CTAs.

Testing and optimizing

In order to get the most out of your pay-per-click advertising efforts, testing and optimizing your campaign over time is essential.

This can include everything from A/B testing different copy and imagery to tracking your results using conversion tracking digital tools.

By continuously optimizing them based on performance data, you can ensure that you are spending your marketing budget wisely and reaching your ideal clients.

Add retargeting to your strategy

Marketing for insurance agencies can become costly fast.

Fortunately, Once you start to get traction, you can retarget people that already showed interest in your previous campaigns for a lower cost.

This will be your most valuable audience since they’ve already been qualified and are more likely to convert.

How long does it take to see results from your insurance PPC advertising

This is a difficult question since it will depend on numerous factors, such as your target market, channels, and overall goals.

However, you should start seeing results within a few months with a well-defined strategy.

Remember that building trust with potential customers takes time, so don’t expect instant results.

Developing your life insurance PPC advertising campaigns

Developing an adequate insurance marketing strategy is essential for any insurance agent who wants to grow their business.

Following the tips outlined in this article, you can create a strategy to help you connect with potential customers and convert leads into clients.

Additionally, don’t forget to take advantage of tools like retargeting and A/B testing to maximize your results and get the most out of your marketing efforts.

Insurance advertising FAQ

What must be included in insurance advertisements?

In order for an insurance advertisement to be effective, it must include a strong call-to-action, emotional trigger, and brand identity. Additionally, it is essential to consider your target market and the channels you are using in order to ensure that you are reaching the right people with your messaging.

What is the best way to advertise insurance?

There is no one “best” way to advertise insurance, as different methods will work better for other businesses depending on their unique needs and goals. However, some practical ways to advertise insurance include PPC advertising, social media marketing, SEO, and video ads.

Is it illegal for an insurance company to advertise?

There are no legal restrictions on advertising insurance. The advertisements follow FTC guidelines and include all required disclosures. However, it is essential to note that insurance companies are subject to regulations that can impact their advertising ability. This includes licensing requirements and limitations on the use of specific advertising channels.

How do I advertise my life insurance?

There are many different ways to advertise your life insurance, including online advertising, paid search advertising, and social media marketing. In order to be successful, it is vital to develop a comprehensive marketing strategy that takes into account your target audience, budget, and other factors. Additionally, you want to consider using strategies like retargeting and A/B testing to maximize your results.

What must be included in a life insurance advertisement?

A successful life insurance advertisement should include a strong call-to-action, compelling imagery, or copy that conveys the benefits of your product and your agency branding. Additionally, it is crucial to consider your target market and the channels you are using when planning your ad campaign.

Do Google Ads work for insurance?

Google Ads (also called Google AdWords) help insurance agents reach wider audiences by displaying ads on search engines and sites in their network. There is no guaranteed way to make your Google Ads successful. Some best practices for an effective campaign include using high-quality keywords, building buyer personas, and tracking your results.