Digital marketing for banks is becoming increasingly important now that there are more options available thanks to digital banks.

A customer can open a bank account in minutes from their computer.

The desire to go to a local bank or credit union is no longer as strong as it used to be.

This digital marketing strategy guide will build your bank’s online presence and show how financial brands can benefit from putting more focus here over traditional marketing strategies.

Why your bank needs a digital marketing strategy?

Local financial institutions had several benefits, such as building in-person customer relationships, trust, and a sense of community.

With the rise of digital banks and direct deposits, people are no longer as likely to visit their local bank branches.

According to a survey by FDIC, households primarily use mobile banking for other banking needs but still prefer to have a branch option if necessary.

Now that technology has made it easier for customers to do their banking without visiting a branch, local banks need to focus on their digital marketing strategy.

As millennials and gen Zers come of age where a digital lifestyle is a norm, banks need to focus on their online presence more than ever.

Digital marketing for banks

1. Connect with customers where they are

Social media has become a necessary tool for businesses in nearly every industry, including the banking industry.

Most people have some form of social media, whether it’s Facebook, Twitter, Instagram, or LinkedIn.

According to a survey by PwC, over 34% of consumers would prefer to avoid branches altogether. In the same survey, over 25% of consumers said they would prefer to open an account digitally.

If your financial institution is not developing an effective marketing strategy for social media management, you could miss out on a huge opportunity.

Your customers are using social media, so why not connect with them where they are?

You can build trust and relationships with potential and existing customers by being active on social media.

2. Push record and increase views

Short-form videos can be beneficial in your digital marketing strategy.

Facebook and Instagram Reels, YouTube Shorts, and TikTok are all popular short-form video platforms you can utilize to reach your target audience.

Nowadays, consumers prefer How To and educational videos.

This is perfect for bank digital marketing because you can educate viewers on a particular topic and end the video with exactly How To do this through the bank’s services.

You can also use video content to show your community involvement or highlight the customer experience they wouldn’t receive through digital banking.

Video is a great way to connect with potential and existing customers in a way that feels more personal than other types of

3. Share valuable content your customers need

While video consumption continues to grow, there is still a massive amount of opportunity in text-based content like blogging.

Google still accounts for most of the web traffic, and the primary content that still shows in organic search results is text-based.

Blogging should be one of your primary blogging strategies.

While social media is excellent, you don’t have control over these platforms.

So use blogging and your website as the foundation of your content strategy, and use these other platforms to share and distribute your content.

This will also give you more control over your content’s ranking and help increase website traffic.

Be sure to write blog posts that are relevant and valuable to your target audience.

Include call-to-actions that encourage readers to learn more about your products and services.

4. Make sure you are easily found online

Blogging is the first step, but without a focus on Organic SEO, your audience may not see your content.

Search engine optimization is the practice of optimizing your website to rank higher in search engine results.

Do this through on-page SEO tactics like using the right keyword throughout your website and blog posts and off-page SEO tactics like link building and social media engagement.

Search engines work for you 24/7 and are necessary for a well-rounded digital marketing strategy.

Your banking website and content are your digital marketing foundation. This is a critical step in your overall process.

➡️ If you need inspiration for your banks new website or redesign, our article “11 Best Credit Union and Bank Website Designs 2023‘ is for you.

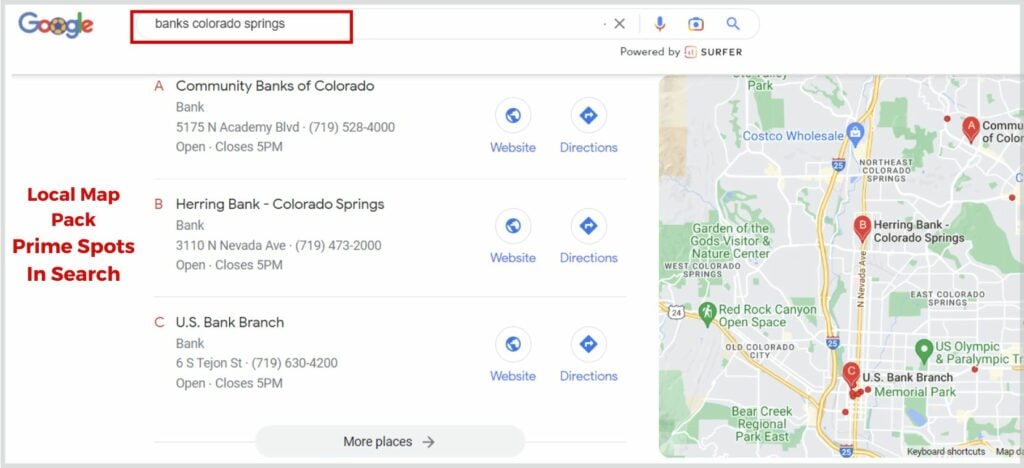

5. Make sure people in your area know you’re there

Local SEO has many of the same principles as Organic SEO.

Instead, it’s hyper-focused on ensuring you show up in search engine results for people searching in your geographic area.

This is key for financial institutions because most people want to bank with an institution close to them.

To do this, list your business on Google Business profile (formally known as Google My Business), Bing Places, and other local directories.

Also, be active on social media platforms like Nextdoor and ensure your website is optimized for mobile devices since most people search for businesses on their smartphones.

If someone is near your branch and searches for “Banks near me,” you want to be sure your financial institution appears high on the results and Google Map listings.

6. Lock in guaranteed views of your content

Digital advertising can make sure your best prospects are seeing your content.

Community banks may have customers several miles away, but the ROI significantly decreases the further out you go.

You want to focus on building a radius around each of your branches and ensure people within that area see your content.

You can do this through Google Ads, which allows you to show up on the search engine results page for relevant financial keywords as well as on websites throughout the internet.

Social ads are another great way to utilize content that has already been shown to be popular with potential customers.

You can use your social media analytics insights to see which posts are getting the most engagement.

Then use those same posts as ads on your social media campaigns.

7. Connect with customers in their personal spaces

You have to be very tactful when it comes to email marketing because people are very selective about where they put their attention in their inboxes.

However, if done correctly, it can be a great way to nurture current customers and turn prospects into leads.

There’s a reason this is a primary focus for bank marketers. And it should be for your financial marketing team as well.

It only takes one lousy email to hurt your chances of your potential customer ever opening another email or unsubscribing altogether.

Creating engaging content and segmenting your email list, so you’re only sending messages to people who will find them relevant will improve open rates.

All successful digital marketing efforts should lead to your email list.

The ROI on this is far too high out of all digital marketing strategies mentioned.

Tip: Once you get them to open your email, you want them to go to the next step. Increase your email clicks by up to 300% when you add a video to your emails.

8. Break through the noise by creating more noise

Content marketing encompasses everything mentioned and deserves its own section because it’s that important.

Banks and credit unions must be strategic regarding their content because the competition is stiff, and people are bombarded with marketing messages daily.

You need to break through the noise by creating more noise.

This can be done by publishing high-quality far beyond what was mentioned in this article.

Create visuals like infographics, offer reports, eBooks, and more that will be valuable to your target market.

Whichever marketing channels or strategies you use, ensure your content is highly shareable and optimized for search engines.

Most importantly, focus on creating a sustainable content strategy that will continue to generate leads long after it’s published.

9. Use data to improve your digital marketing campaigns

One of the many benefits of digital marketing that should be used by you and the financial marketers you work with is gathering customer data and key performance indicators.

You can use this data to create more targeted campaigns that reach the right people at the right time with the right message.

This process is known as customer segmentation, one of the essential aspects of effective marketing.

Digital marketing provides you with an unprecedented amount of data that can be used to improve your campaigns and get better results.

Make sure you’re utilizing this data to its full potential and constantly be testing and refining your campaigns.

Be sure to set up all necessary tags and tracking, so you are able to track conversions and ROI for your digital marketing plan.

Final thoughts on digital marketing for banks

Bank marketing should provide a seamless experience for new customers to discover you, open an account, and for existing customers to maintain their relationship with the bank.

An excellent digital marketing plan will consider all aspects of the customer journey and provide a consistent experience across all digital channels.

It’s important to note that your website is the foundation of your digital marketing efforts, and everything should lead back to it.

The banking industry is competitive, and you must differentiate yourself from the rest.

Digital marketing provides you with the opportunity to reach your target market where they are spending the majority of their time – online.

You must be present and provide valuable content to help them make informed financial decisions.